Ethereum’s price is currently navigating a crucial juncture after facing rejection at the $4,000 resistance level. Despite this setback, bullish momentum is beginning to show signs of resurgence, potentially setting the stage for a significant recovery.

### Technical Analysis

#### The Daily Chart

Upon closer examination of the daily chart, Ethereum’s price trajectory has been characterized by lower highs and lows within a descending channel since its inability to breach the $4,000 barrier. However, the cryptocurrency is now reclaiming ground above the $3,000 mark and the midline of the channel. A successful recovery to these levels could pave the way for a breakout above the channel, signaling a potential move towards $4,000 and beyond.

#### The 4-Hour Chart

A closer analysis of the 4-hour chart provides a clearer view of recent price action. While the market has struggled to breach the $3,000 resistance zone, it is currently testing the midline of the descending channel. With the Relative Strength Index (RSI) reflecting values above 50%, there is a likelihood of Ethereum surpassing this level and targeting the $3,600 resistance area. This optimistic scenario suggests a potential onset of a new bullish wave in the near future.

### Sentiment Analysis

#### Ethereum Funding Rates

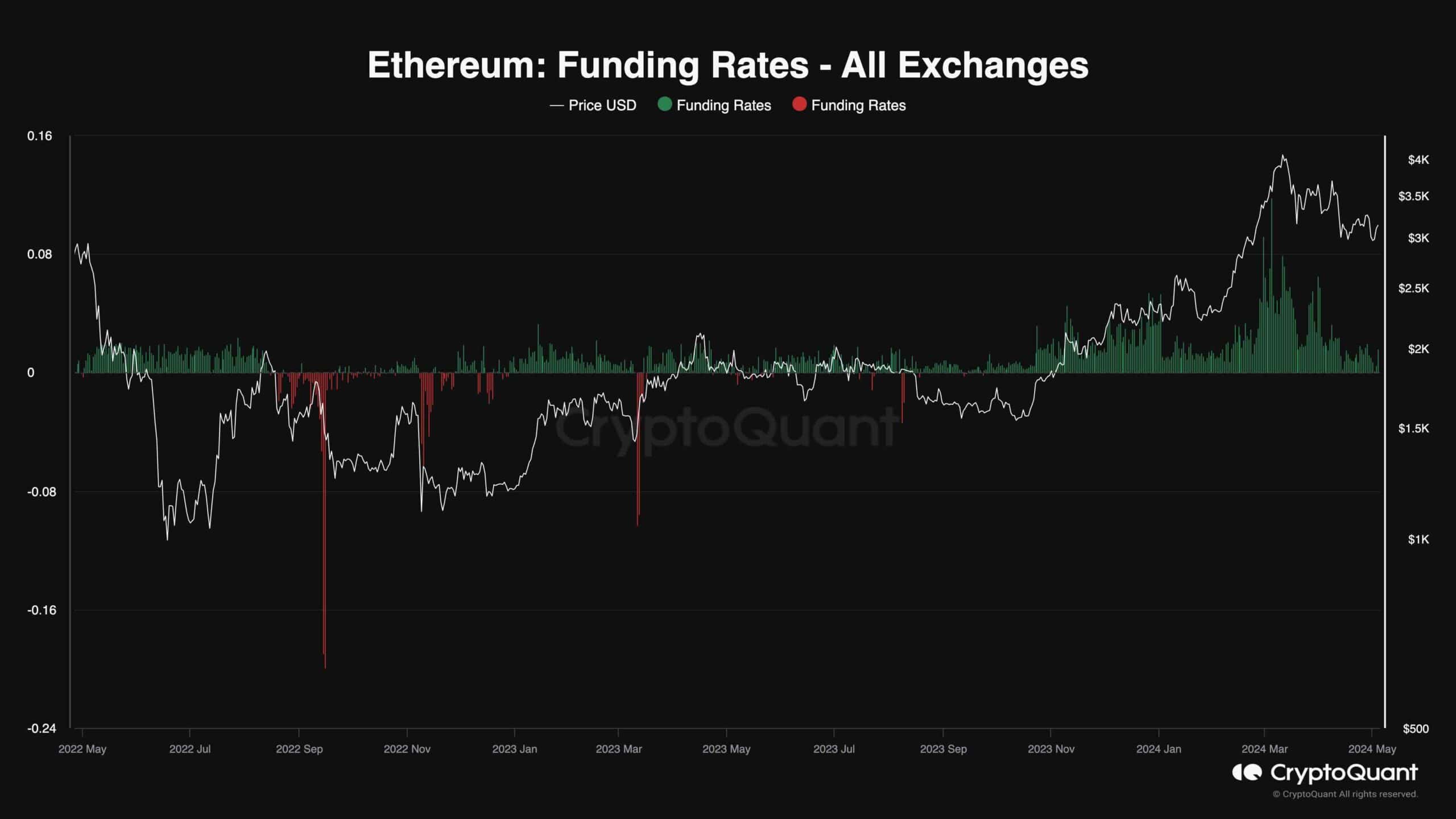

In light of Ethereum’s recent price decline, many futures traders have either been liquidated or reversed their long positions, signaling a cooling down of the futures market. Analyzing the Ethereum funding rates metric, which gauges the aggressiveness of buyers versus sellers in executing futures orders, reveals a noteworthy shift. The funding rates have notably decreased compared to previous months, with low but positive rates indicating a bullish sentiment. This suggests that while the futures market has stabilized, the underlying demand remains intact, hinting at a potential price rally in the near term.