Bitcoin’s price has been consolidating for a while now, failing to continue the significant bullish momentum observed over the past few months. Yet, things are still looking positive for BTC in the short term.

Technical Analysis

By TradingRage

The Daily Chart

On the daily chart, the price has been aggressively attacking and breaking through resistance levels one at a time. However, the market is currently consolidating above the $40K level as the bullish momentum has faded away. The decrease in the relative strength index confirms this idea. The RSI is still showing values above 50%, indicating that the momentum has yet to shift bearish. Therefore, with a strong support level at $40K, the price is still likely to reach the $48K resistance zone in the coming weeks before any major correction occurs. The symmetrical triangle can both be a continuation and a reversal pattern, depending on the direction of the potential breakout.

The 4-Hour Chart

As the 4-hour timeframe depicts, the recent consolidation has formed a classical price action pattern, the symmetrical triangle. This pattern can indicate either a continuation or a reversal, depending on the direction of the potential breakout. Investors can be optimistic that the price will eventually rally toward the $48K level in case a bullish breakout occurs. On the other hand, a bearish breakout can lead to a deeper correction in the near future.

On-Chain Analysis

By Shayan

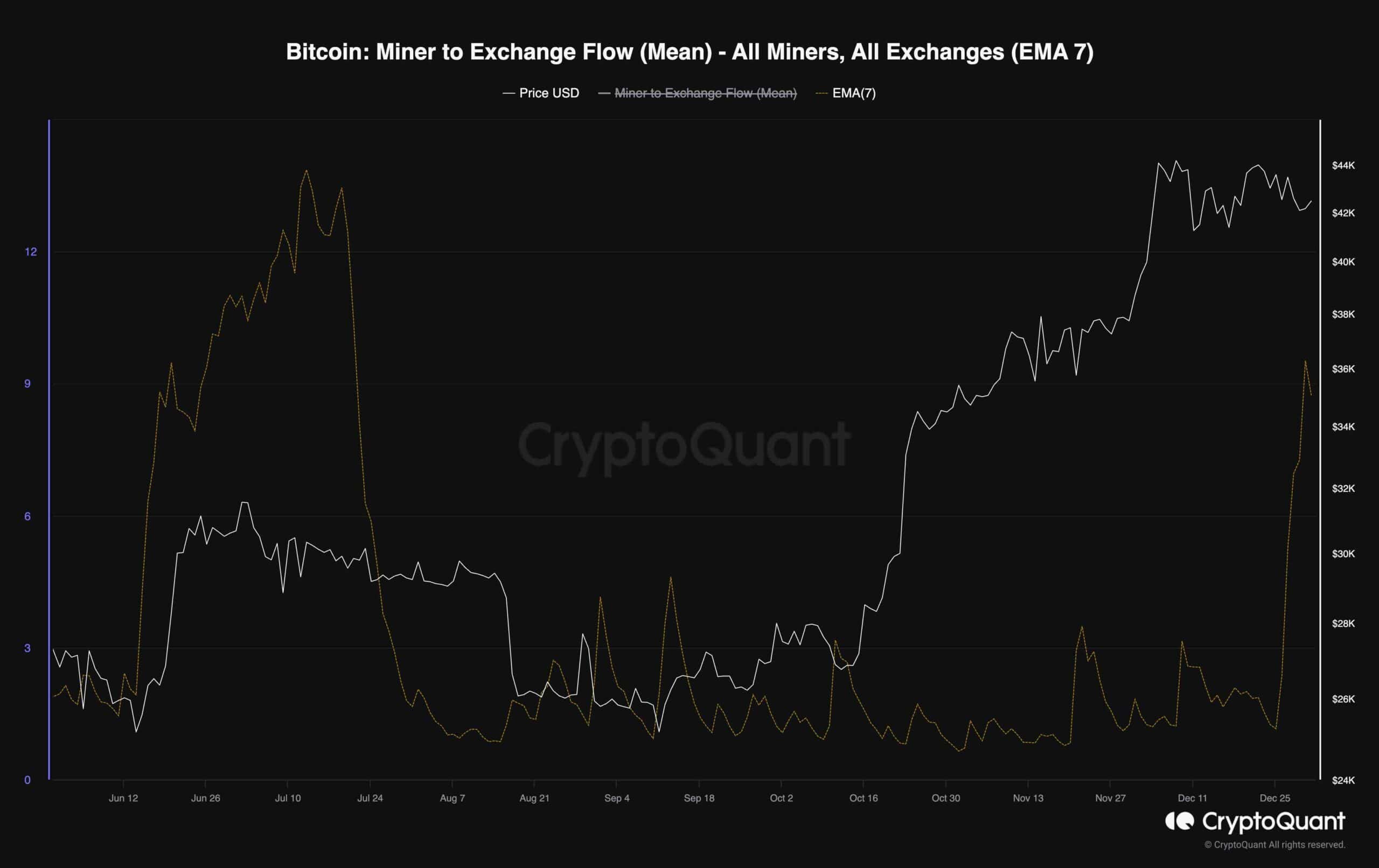

Miner to Exchange Flow (mean)

The chart illustrates the 7-day exponential moving average applied to the Miner to Exchange Flow (mean) metric in correlation with Bitcoin’s price. This unique metric indicates the volume of coins transitioning from miners to exchanges, offering insights into potential selling pressures originating from miners. Historically, downturns in Bitcoin’s price have aligned with instances where miners initiated the transfer of their Bitcoin holdings to SPOT exchanges. However, a noteworthy shift has recently unfolded as the metric experienced a substantial surge following Bitcoin’s price reaching the $45K mark and entering a consolidation stage. This development suggests miners are realizing profits and raises the possibility of a market reversal if the metric continues to surge, reaching levels of concern. Monitoring this metric becomes crucial for anticipating potential shifts in market dynamics and adjusting strategies accordingly.