Solana has recently marked a notable achievement in the world of cryptocurrencies. As a crypto journalist, Laura Shin stated that the network’s daily stablecoin transfer volume has witnessed a remarkable 600% increase as of December 2023 on X (formerly Twitter). This surge, bringing the volume to $16.6 billion, catapults Solana ahead of established blockchain networks like Ethereum, Tron, BNB Chain, and Arbitrum.

.@Solana now leads the pack in daily stablecoin transfer volume, reaching $16.6 billion on Monday, per institutional blockchain analytics platform @artemis__xyz, @httpsageyd reports.https://t.co/csCY9Jvxlp

— Laura Shin (@laurashin) December 19, 2023

In 2022, its daily transfer volumes fluctuated between $33 million and $743 million, never crossing the billion-dollar mark. Nirmal Krishnan, Head of Engineering at Artemis, while shedding light on this growth stated:

The JTO airdrop on December 7 was a catalyst, propelling Solana ahead of Ethereum in terms of DEX and NFT trading volume

This upsurge in stablecoin volume is a testament to the heightened activity and liquidity within Solana’s ecosystem. The recent integration of the Euro Coin (EURC) by Circle, a prominent USD Coin (USDC) issuer, further bolsters Solana’s position. These developments provide fertile ground for decentralized finance applications and digital wallets on Solana, enhancing its appeal and utility.

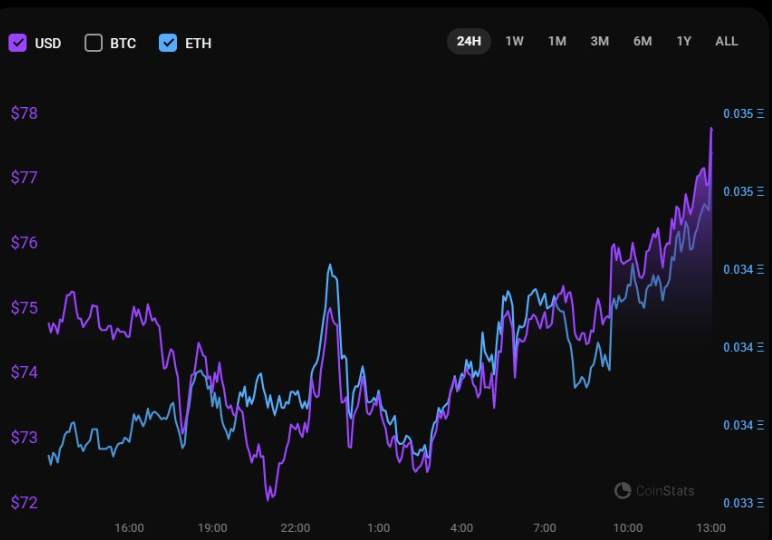

The impact of these developments is evident in Solana’s market performance. Solana trades at $76.66 at press time, with a 24-hour volume of over $2 billion, marking a 2.07% increase, per CoinStats. Conversely, Ethereum, despite its larger market cap, has seen a 1.19% decrease, trading at $2,217.54 with a volume surpassing $10 billion.

SOL vs. ETH 1-day price chart (Source: CoinStats)

Solana’s price resurgence has revitalized its on-chain activities. The network’s transaction count and total value locked (TVL) have significantly increased. From September 2023 lows, SOL’s value has more than tripled. Correspondingly, its DeFi TVL, per DeFiLlama data, has also tripled from July 2023, now exceeding $1 billion.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.