The current crypto market is experiencing strong price movements, resulting in notable gains for top tokens. Bitcoin (BTC) remains steady above $66K, indicating a positive outlook for these tokens in the near future.

However, not all areas of the market are thriving. Solana-based memecoins like dogwifhat (WIF) and BOOK OF MEME (BOME) have shown a decline in recent times.

In the last 24 hours, both WIF and BOME have seen a decrease in value. WIF dropped by 4.01%, while BOME fell by 6.05%, signaling a decrease in interest within the memecoin sector of the crypto market.

Regarding the WIF token, ranked as the 41st largest cryptocurrency by market cap, it has experienced a decline in value over the past day. Its market cap is down 4.13%, reaching $2,838,673,268, accompanied by a 43.34% decrease in trading volume, indicating reduced investor activity around WIF.

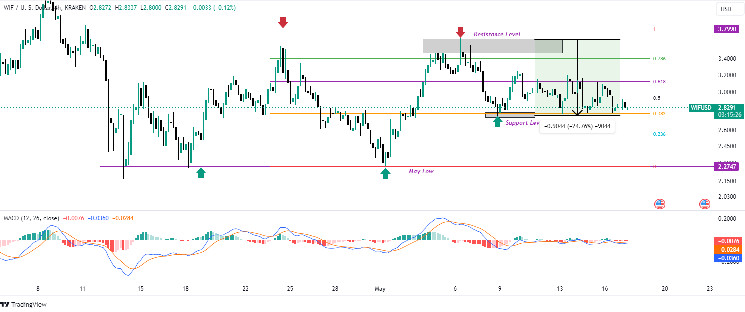

Analyzing the 4-hour chart, WIF has seen a significant downturn, currently trading at a support level of $2.748. If this level holds, a potential price rally could ensue, challenging the 61.8% Fibonacci retracement level and possibly reaching $3.47. However, a failure to maintain this support level may lead to further declines, seeking lower support levels around the lows of May.

Turning to the BOME token, its trading volume has dropped by 46.99% over the last day, reflecting diminishing investor interest. Technically, BOME is at the 50% Fibonacci retracement level on the 4-hour chart, with a breach below signaling potential further declines to the 38.2% Fibonacci level and even lower.

On the flip side, overcoming the 50% Fibonacci level could fuel a rally for BOME, aiming for the 61.8% Fibonacci level and beyond. However, both WIF and BOME show weakening bullish momentum in the Moving Average Convergence Divergence (MACD) indicator, hinting at a possible market correction.

In conclusion, these insights provide valuable information for investors and traders in the crypto and NFT space. It is crucial to monitor market developments closely and exercise caution in decision-making.