- Ethereum bulls drive up ETH’s price as Fear and Greed Index signals heightened investor optimism.

- Michael Saylor shifts stance, now sees spot ETH ETFs as a positive for Bitcoin.

- Ethereum’s Pectra upgrade set for launch in Q1 2025.

Ethereum (ETH) saw a 3% increase on Monday, reflecting a surge in bullish sentiment among investors. Notably, Michael Saylor shared his thoughts on the recent spot ETH ETF approval by the Securities & Exchange Commission (SEC).

Daily Market Recap: Bulish Trends, Michael Saylor, and Pectra Upgrade

Following Monday’s price surge, trading firm QCP Capital observed a growing bullish outlook on Ethereum, driven by expectations of institutional demand upon the launch of spot ETH ETFs.

ETH has experienced a 27% uptick since last week, fueled by the SEC’s approval of issuers’ 19b-4 filings from exchanges. While awaiting S-1 application approvals from the regulator, analysts anticipate a bullish trend, evident in the ETH Fear and Greed Index hitting 76, indicating heightened investor confidence.

QCP Capital emphasized, “While our outlook on ETH remains positive, a significant breakout may be contingent on S-1 approvals and inflow data, which are expected in due course.”

Meanwhile, Grayscale’s CEO, Michael Saylor, previously skeptical about spot ETH ETF approvals, now recognizes their value for Bitcoin’s ecosystem. Saylor believes that a spot Ethereum ETF adds another layer of support for Bitcoin amidst the evolving crypto landscape.

Additionally, Ethereum developers have outlined plans to release the Pectra upgrade in Q1 2025 following the Dencun upgrade in March. Key features of the Pectra upgrade include:

- Ethereum Improvement Proposal EIP-7251, raising the maximum staked ETH per validator from 32 to 2,048 ETH.

- EIP-7702 replacing EIP-3074 to enable account abstraction where Ethereum addresses can temporarily function as smart contracts.

- Introduction of Ethereum Virtual Machine Object Format (EOF) to enhance the EVM code framework for Main Chain and Layer 2 functionalities.

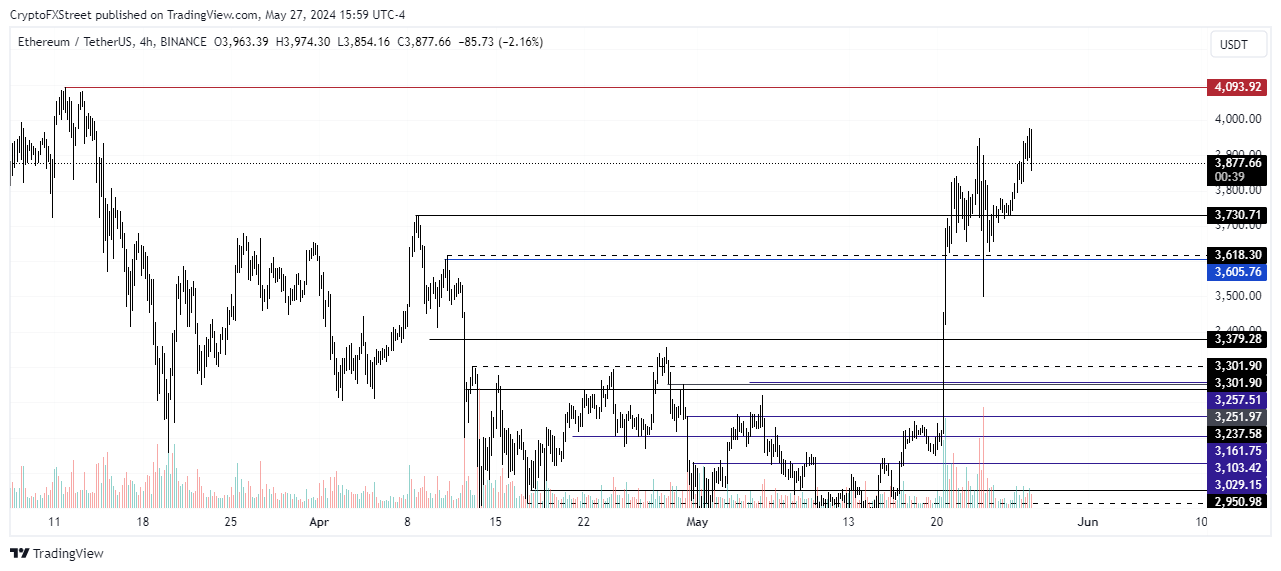

ETH Technical Analysis: Testing Resistance Levels

With Ethereum currently priced at $3,924 post a 3% gain, ETH bulls remain resilient, evidenced by lower long liquidations compared to short liquidations.

Although ETH has faced resistance at the $4,000 level post-ETF approval, a potential breakthrough is anticipated once the market fully reopens on Tuesday. Surpassing $4,000 could propel ETH towards the $4,093 resistance level, marking a significant milestone since December 2021. Should bullish momentum wane, the $3,605 support level holds promise.

ETH/USDT 4-hour chart

Forecasts indicate potential for substantial gains in ETH over the upcoming weeks, with projected spot ETH ETF inflows post S-1 approvals potentially propelling ETH to a new all-time high above $4,878.

Share: Cryptocurrency News