The crypto market faced a significant downturn amidst escalating geopolitical tensions following Iran’s missile strikes on Israel. Bitcoin, in particular, saw a dip below $60,500 before initiating a modest recovery.

Despite the turmoil, recent findings indicate that demand from United States-based investors remains robust. This sustained interest could potentially offer Bitcoin some relief from the prevailing bearish sentiment.

US Investor Demand Strengthens

A post dated October 3 by CryptoQuant highlighted the possibility of a short-term price surge for Bitcoin.

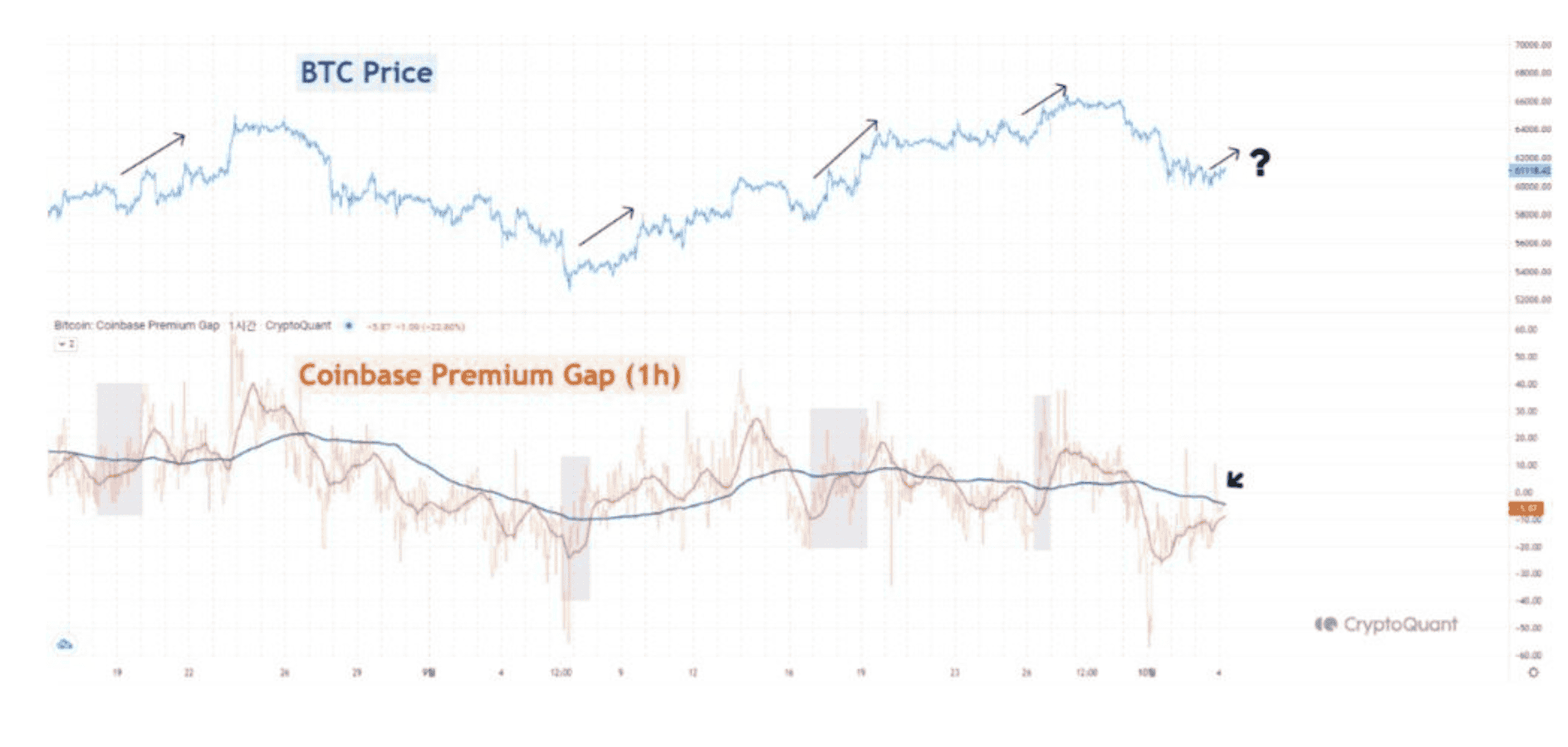

The Coinbase Premium Index is indicating a potential uptick in Bitcoin’s price in the near future. By monitoring the 1-hour timeframe and comparing the 24-hour and 168-hour moving averages, CryptoQuant analyst Yonsei_dent observed a bullish signal when the daily moving average crosses above the weekly moving average.

Currently, the daily average has momentarily exceeded the weekly average, with the gap between the two narrowing, signaling a bullish momentum. In past instances, this pattern has preceded short-term price spikes, as was evident on October 1st, propelled by strong demand from US investors that pushed Bitcoin higher despite a temporary correction.

The increasing Coinbase Premium suggests a similar scenario, with a rising interest from US investors potentially hinting at a recovery in Bitcoin’s price.

Bitcoin Records Significant Outflows from Exchanges

Supporting this optimistic outlook, an analysis by CryptoQuant highlighted that Bitcoin witnessed its largest outflow from exchanges since November 2022, signaling a shift in market sentiment.

On-chain data illustrates a substantial surge in outflows, with the 30-, 50-, and 100-day moving averages all reflecting this trend. A notable outflow typically indicates that investors are transferring their Bitcoin to private wallets, reducing the supply on exchanges and potentially exerting upward pressure on the asset’s price.

This pattern often signifies investor confidence in Bitcoin’s long-term prospects, choosing to hodl rather than actively trade, which could serve as a bullish indicator for forthcoming market dynamics.