Polkadot’s price has recently faced significant selling pressure, leading to a break below the key $6 support level. This has raised concerns about a bearish trend persisting in the market.

This development suggests a bearish sentiment in the market, with a possibility of further downward movement.

Technical Analysis

By Shayan

The Daily Chart

Analysis of the daily chart shows that DOT encountered strong selling pressure around the critical $6 support area, causing a significant breach of this key level. This not only highlights the intense selling pressure in the market but is also reflective of a broader trend affecting all altcoins. The price has broken below a multi-month triangle and previous major swing lows, indicating a clear bearish sentiment.

In addition, the 100-day moving average has crossed below the 200-day moving average, forming a death cross. This further confirms the prevailing bearish sentiment. Consequently, the price is likely to decline towards the important $5 support level and could undergo a consolidation phase around this range.

The 4-Hour Chart

Looking at the 4-hour chart, DOT has experienced increased selling pressure leading to bearish retracements. This has resulted in the formation of a bearish price channel, with the cryptocurrency currently trading near the lower boundary.

After breaking below the critical $6 level, the price retraced back to this level, confirming the bearish scenario. Expectations are for DOT to witness heightened volatility in the short term and continue moving towards the crucial $5.4 support. A consolidation phase between $5.4 and $6 levels is likely in the medium term.

Sentiment Analysis

By Shayan

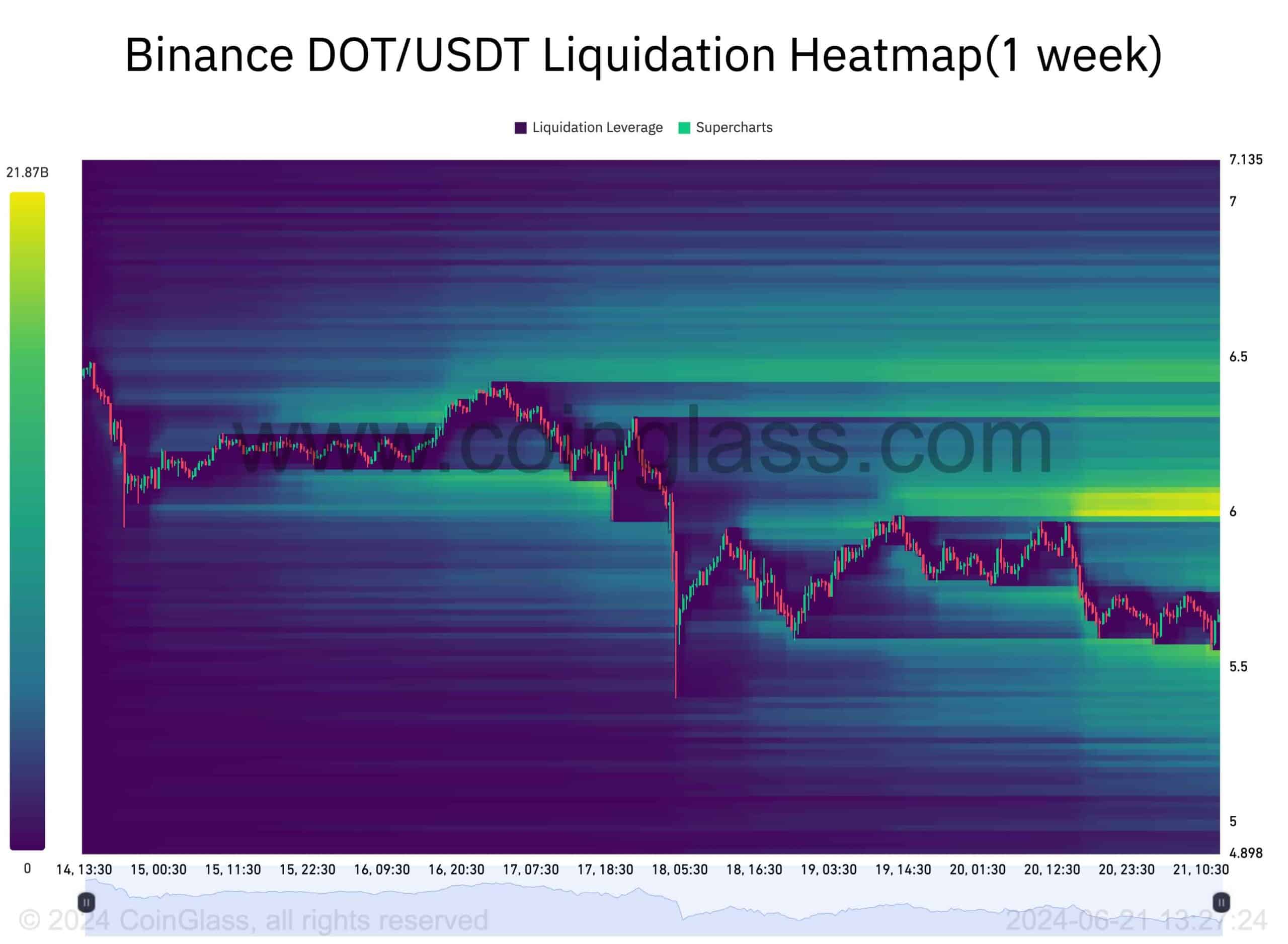

After breaking below the important $6 support level, Polkadot’s price triggered a significant long-squeeze event, leading to the liquidation of numerous long positions. Understanding this event is key to assessing potential future market movements.

The accompanying chart depicts potential liquidation levels in Polkadot’s price action, offering insights into where institutional investors may focus in the medium term. Notably, there is substantial liquidity near the $6 mark, likely comprising buy-stop orders from aggressive short positions initiated around this crucial level.

If a bullish correction occurs, buyers will target the $6 level to capitalize on liquidity and potentially retest the previous support level. However, the price’s ability to attract liquidity at this level could determine whether the bearish trend will continue.