IBIT leads competitors in year-to-date inflows, showcasing growing investor confidence in crypto.

Key Insights:

- BlackRock’s iShares Bitcoin Trust (IBIT) attracted a substantial $329 million despite Bitcoin’s price decline.

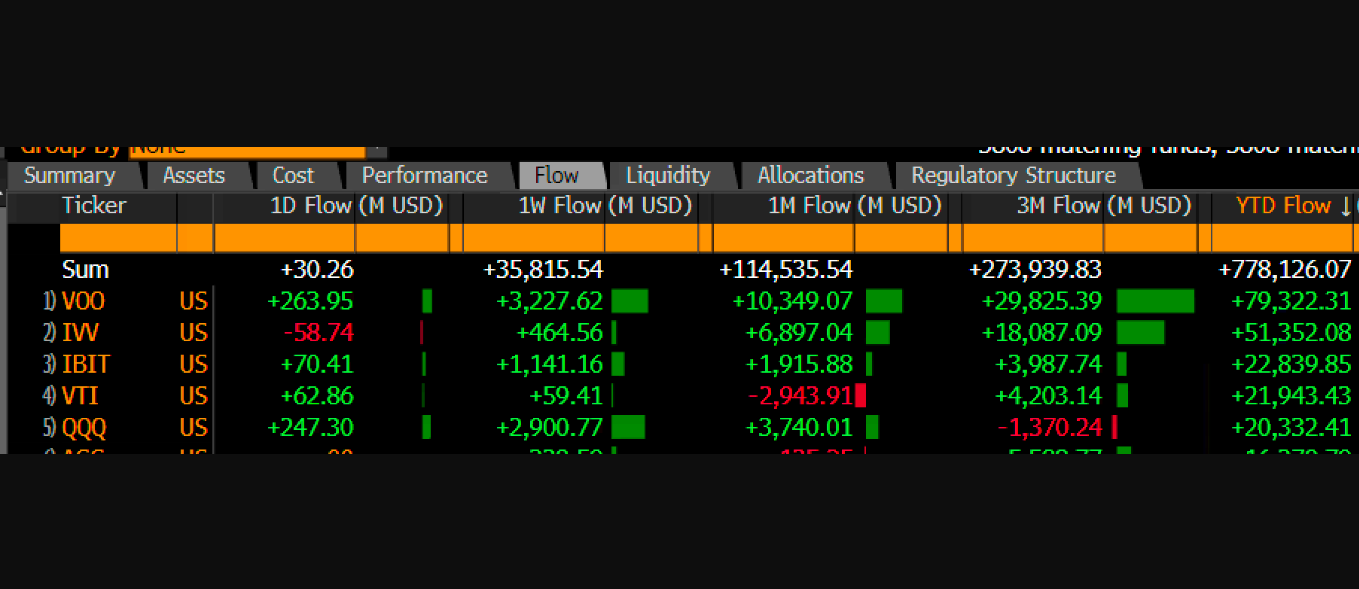

- IBIT has outperformed Vanguard’s Total Stock Market ETF in terms of year-to-date inflows.

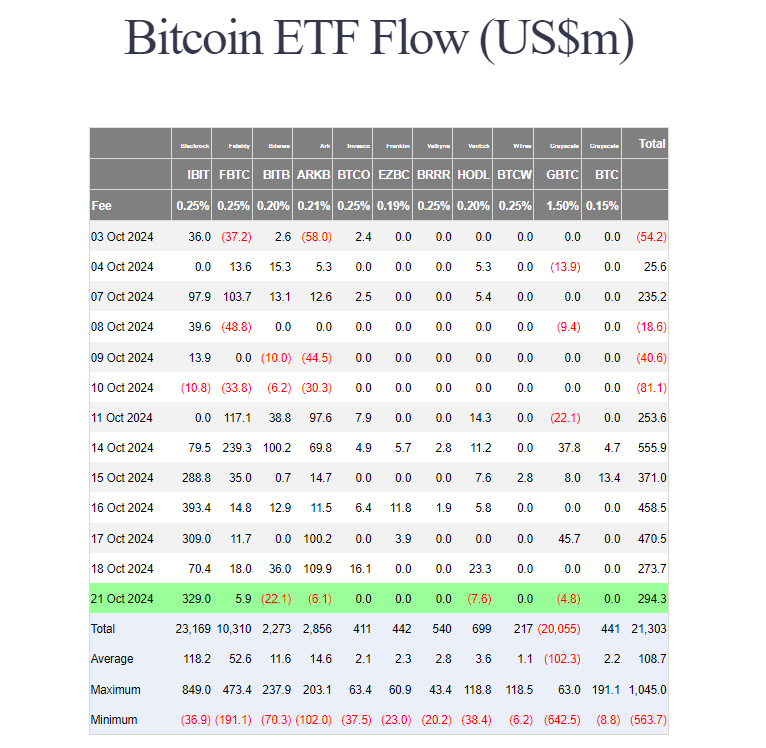

On Monday, IBIT, managed by BlackRock, recorded a remarkable $329 million in new investments even as the price of Bitcoin dipped below $67,000. This success contributed to the overall positive performance of US spot Bitcoin ETFs, which have seen net buying surpassing $2.5 billion over the past seven days, based on data from Farside Investors.

Fidelity’s Bitcoin Fund (FBTC) also observed gains of approximately $6 million on the same day. However, rival ETFs from Bitwise, ARK Invest/21Shares, VanEck, and Grayscale (GBTC) faced redemptions totaling over $40 million, with no inflows reported for the other competing ETFs.

IBIT by BlackRock continues to attract investors seeking exposure to Bitcoin, with over $1 billion in net capital inflows last week alone, constituting half of the total US spot Bitcoin ETF inflows.

ETF analyst Eric Balchunas from Bloomberg noted that IBIT has now surpassed Vanguard’s Total Stock Market ETF in year-to-date inflows, securing the third position overall less than ten months since its launch.

Recent data from BlackRock shows that as of October 18, IBIT held Bitcoin assets worth $26.5 billion, reflecting its substantial presence in the market.

Despite price fluctuations, sustained interest in Bitcoin ETFs indicates strong institutional involvement in the crypto space. Market stability may be influenced by upcoming US elections and global tensions.

After peaking at $69,500 on Monday, Bitcoin’s value dipped below $67,000 and is currently trading around $67,400, showcasing a 2% decrease in the last 24 hours, as per CoinGecko.