Fidelity Investments’ Director of Global Macro, Jurrien Timmer, sheds light on the recent slowdown in Bitcoin adoption.

While Timmer acknowledges Bitcoin as “exponential gold” and a potential store of value, he emphasizes the divergence between the deceleration in Bitcoin’s network growth and its price movements.

Network Growth vs. Price Gains

Timmer points out that Bitcoin’s price is primarily influenced by its network growth, scarcity, monetary and fiscal policies, and market sentiment. Despite price gains, the network growth of Bitcoin has slowed down, leading to a divergence that may explain the recent slowdown in adoption.

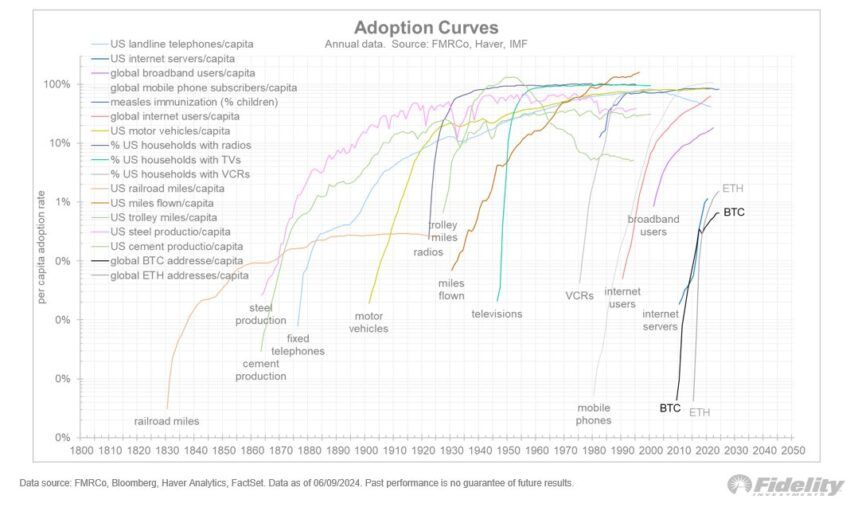

In his analysis, Timmer draws parallels between Bitcoin and Ethereum’s growth curves with historical technological advancements. He highlights Bitcoin’s network growth, represented by non-zero addresses, following a power curve, with price oscillating around it, creating a unique boom-bust cycle specific to Bitcoin.

Explore more: How To Buy Bitcoin (BTC) and Comprehensive Guide

Analysis of BTC and ETH Adoption Curve. Source: X/TimmerFidelity

“The divergence between price and adoption could be a reason for Bitcoin’s recent slowdown on the path to potential new all-time highs. For new highs to be sustained, the network may need to accelerate once again. Is the next chapter in the fiscal dominance thesis the driving force behind this acceleration?” Timmer posed the question.

Veteran trader Peter Brandt adds to the discussion by noting the diminishing gains in each bull market cycle and suggesting that the current advance may be nearing its conclusion.

“Given the nature of the power curve and price discovery towards a mature asset, it aligns with the dynamics we are seeing,” Timmer responds to Brandt’s perspective.

Why Bitcoin’s Reduced Circulation Might Signal Positive Developments

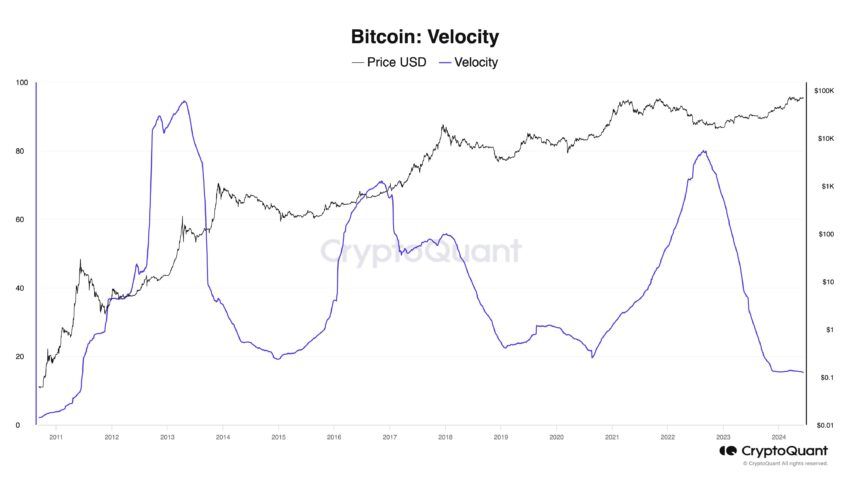

Ki Young Ju, founder and CEO of on-chain analytics platform CryptoQuant, weighs in on the situation by highlighting Bitcoin’s circulation velocity hitting its lowest point since 2013. He anticipates that the velocity will eventually peak as Bitcoin becomes more widely used for transactions.

As Bitcoin transitions from its original purpose of “P2P Electronic Cash” to “Digital Gold,” with institutions holding it for value storage rather than frequent transactions, traditional adoption metrics may require adjustment to reflect the current landscape accurately.

“The concentration of funds in a few custodial wallets like ETFs challenges traditional adoption metrics. To gauge the adoption curve effectively, distinguishing between cohorts for transactional payments and utilizing op_code to measure application usage may be more insightful,” Ju suggests.

Evaluation of Bitcoin’s Velocity. Source: X/ki_young_ju

Ju’s insights align with the increasing trend of institutional interest in Bitcoin investments, exemplified by companies like DeFi Technologies and Metaplanet incorporating Bitcoin into their treasury reserves.

Moreover, the observations by experts and the growing institutional interest underline the divergence between Bitcoin’s price fluctuations and network growth, indicating that Bitcoin’s journey is far from over.