Peter Brandt, a well-respected trader and chartist in the crypto industry, has issued a cautionary message to bitcoin investors regarding concerning market patterns. He pointed out that BTC has now gone 30 weeks without achieving a new all-time high (ATH), a historical indicator that has previously led to significant market downturns of up to 75%. While Brandt maintains a positive outlook, predicting a bitcoin price of $135,000 by late 2025, he has highlighted the importance of monitoring the $48,000 support level as a potential signal for the market’s direction.

Peter Brandt Highlights Bitcoin Market Trends to Watch

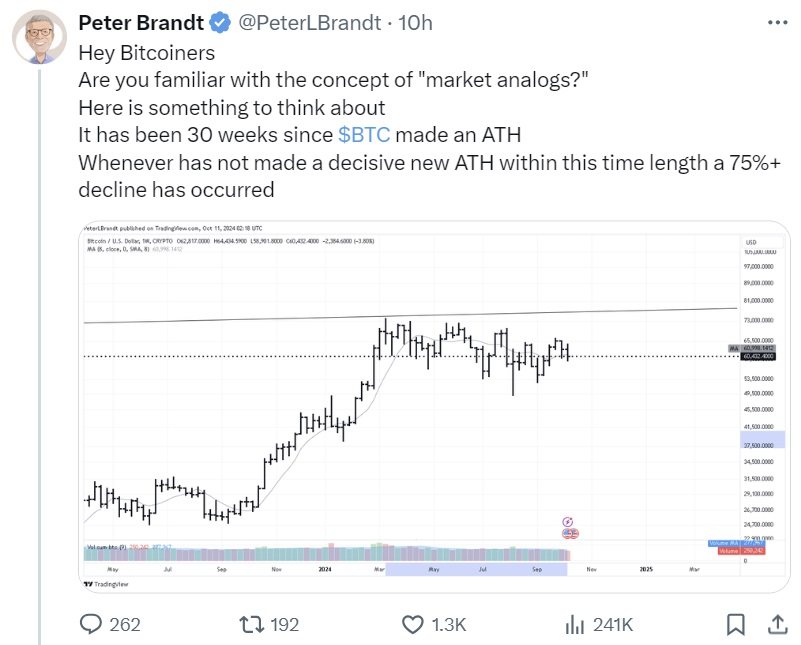

Delving into the concept of “market analogs,” Peter Brandt, a prominent figure in the crypto and NFT field, shared insights on social media platform X, specifically focusing on bitcoin’s price behavior. He emphasized the significance of BTC’s prolonged period without a new ATH, noting the potential implications based on historical trends.

Referencing past data, Brandt underscored that extended periods without a decisive ATH for bitcoin have historically preceded sharp market declines, with losses sometimes reaching 75% or more. This observation serves as a warning for bitcoin investors, suggesting that a failure to achieve a new ATH could trigger a substantial price correction, based on historical precedents.

Market analogs play a crucial role in analyzing market conditions by comparing current trends with past patterns. Traders and analysts leverage these comparisons to forecast potential market movements, leveraging the idea that history may repeat itself in market cycles. In a subsequent post, Brandt clarified:

Just making an observation. Bitcoin is the largest single tradeable asset in my net worth. He who cannot look both ways usually ends up in a car accident.

In a separate update shared on X, the seasoned trader elaborated on his bitcoin outlook, highlighting the impact of the cryptocurrency’s halving cycles on price performance. He noted that significant price surges often occur in the latter stages of these four-year cycles, following reductions in mining rewards.

Despite recent market stagnation, particularly since March 2024, Brandt maintains a positive stance on bitcoin’s trajectory, targeting a price of $135,000 by August or September 2025. However, he emphasized the significance of monitoring the $48,000 support level, as a breach could invalidate his analysis and prompt a reassessment of market conditions. Brandt remains bullish overall but acknowledges the risks associated with breaching key support levels. He stated:

My target is $135,000 in Aug/Sep 2025 … Close below $48K negates my chart analysis.