Key Takeaways

- FTX’s Chapter 11 reorganization plan was approved by a US bankruptcy court on Monday.

- FTX creditors will receive 119% of approved claims in cash following court approval.

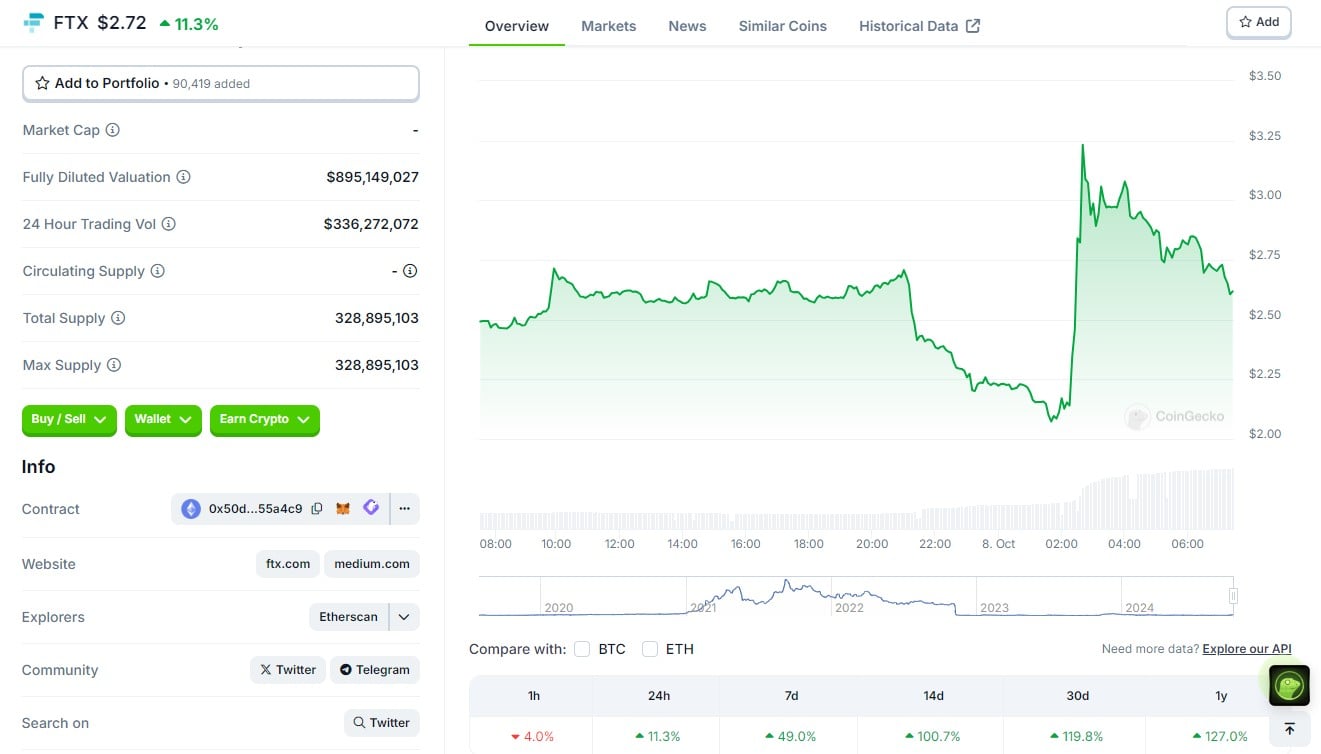

Following the recent court approval of FTX’s bankruptcy plan, FTX’s native token, FTT, surged over 50% to $3.23 on Monday. This approval paves the way for FTX to repay customers in full using $16 billion in recovered assets, including interest.

After the initial surge, FTT has now stabilized around $2.72, as per data from CoinGecko. Over the past two weeks, the token’s value has increased by 100% as investors eagerly awaited a confirmation hearing.

On Monday, Judge John Dorsey in the US Bankruptcy Court for the District of Delaware officially confirmed FTX’s Chapter 11 Plan of Reorganization. This development marks a significant step towards the conclusion of FTX’s bankruptcy saga, almost two years after its collapse.

Judge Dorsey emphasized that the current value of FTX’s native token, FTT, stands at zero, highlighting the challenges the exchange faces in its recovery process.

“I have no evidence today that the value of FTT tokens would be anything other than zero,” said Judge Dorsey.

Under the approved restructuring plan, 98% of creditors are set to receive around 119% of their approved claims within 60 days of the plan’s implementation. This decision follows a resounding vote of approval by 94% of creditors, representing approximately $6.83 billion in claims.

The total estimated funds to be recovered range between $14.7 billion and $16.5 billion, including assets liquidated from various entities associated with FTX. These assets were sourced from FTX itself, its international branches, government bodies, and collaborating parties.

“Today’s achievement is only possible because of the experience and tireless work of the team of professionals supporting this case, who have recovered billions of dollars by rebuilding FTX’s books from the ground up and from there marshaling assets from around the globe,” said John J. Ray III, Chief Executive Officer and Chief Restructuring Officer of FTX. “It also reflects the strong collaboration we have had with governments and agencies from around the world that share our goal of mitigating the wrongdoings of the FTX insiders.”

Although the specific date for the plan’s implementation is yet to be determined, Ray III reassured that funds will be disbursed to creditors across more than 200 jurisdictions. The estate is working with specialized agents to ensure a secure and efficient distribution process.

Despite some resistance regarding payment methods, the plan will move forward with cash distributions, as confirmed during Monday’s court proceedings. With the recent court approval, it is anticipated that FTX customers will begin receiving repayments for their losses in the ensuing months.

FTX, once a prominent player in the crypto industry, faced a downfall in November 2022 due to revelations of misusing customer funds for speculative investments.

The former CEO of FTX, Sam Bankman-Fried, was found guilty on several counts of fraud and conspiracy, resulting in a 25-year prison sentence. Bankman-Fried has initiated an appeal against his conviction for fraud and conspiracy.

Other key figures involved in the FTX fraud, such as Caroline Ellison, CEO of Alameda Research, have also been held accountable. Ellison received a two-year prison sentence last month and is mandated to forfeit $11 billion for her role in the exchange’s collapse.