- Currently, MATIC’s price is bouncing off a crucial support level, and there has been an indication of a relief bounce that the POL rebrand announcement may support.

- Polygon’s transition from MATIC to POL tokens will eventually ease the integration of POL into the network’s primary operations and possibly improve scalability and its TPS.

- Higher trading volume and semi-ascending trend patterns also make investors bullish on MATIC.

Polygon (MATIC), an Ethereum Layer 2 scaling solution, is undergoing a significant transition with the upcoming switch from MATIC to POL tokens. This rebranding is set to commence on September 4, and it has generated a buzz in the crypto industry.

Polygon announced that the migration of MATIC to POL tokens will take place on September 4. POL replaces MATIC as the native gas and staking token of the Polygon PoS network and will play a key role in the AggLayer. MATIC holders on Ethereum, Polygon zkEVM, and CEX may need to…

— Wu Blockchain (@WuBlockchain) August 19, 2024

This transition signifies a strategic move by Polygon to enhance network performance and usability. By shifting from MATIC to POL tokens, Polygon aims to streamline operations and pave the way for improved scalability and transaction processing speed in its ecosystem.

As POL takes over as the primary gas and staking token for Polygon’s PoS blockchain, the gradual transition will bring about advancements in the network’s infrastructure. POL will initially assume the functions currently performed by MATIC, with further integration into the AggLayer project to bolster overall network performance.

Potential Impact on MATIC Price and Market Sentiment

The ongoing transition from MATIC to POL tokens is closely monitored by market participants, especially concerning its impact on MATIC’s price and market sentiment. Observing the technical indicators and price action at the critical support level, traders are anticipating a positive market reaction following the rebrand.

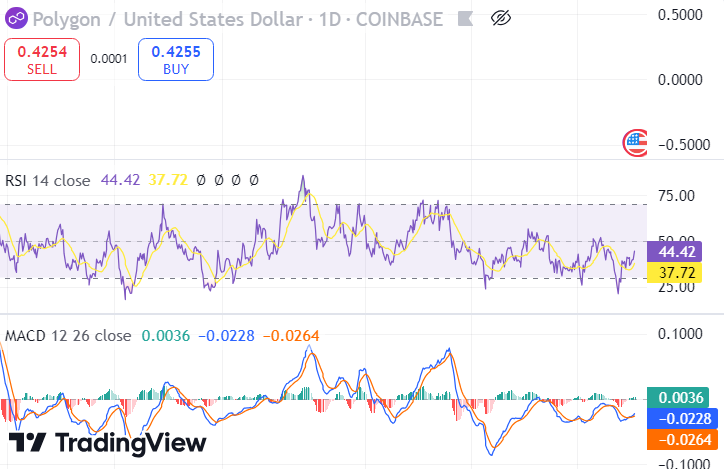

With MATIC trading at $0.4256 and showing a recent 2.62% price increase, accompanied by a surge in trading volume, investor interest in potential price gains post-rebrand is evident. Technical analysis, including indicators like the Moving Average Convergence Divergence (MACD), suggests a bullish trend may be on the horizon.

Source: Trading View

Source: Trading View

Key resistance levels at $0.45 and $0.5 are crucial milestones to watch for, as exceeding these levels could propel MATIC towards retesting the $0.55 level, indicating a stronger bullish momentum. However, it is crucial to acknowledge the associated risks, such as market fluctuations or unmet rebranding expectations, which could potentially exert downward pressure on MATIC’s price.