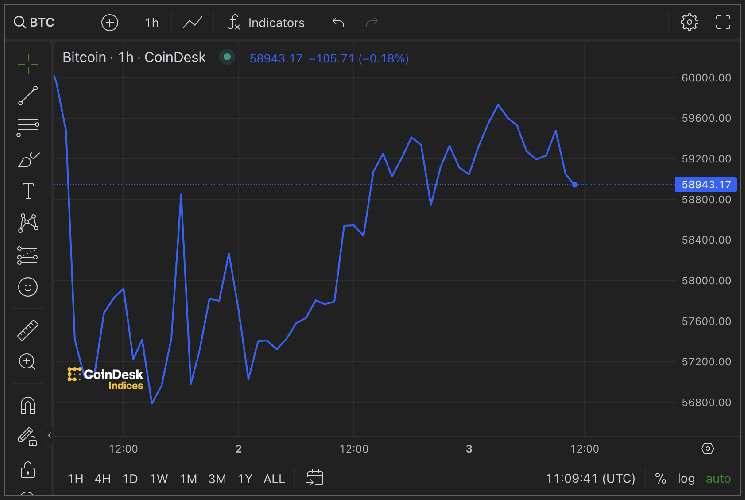

BTC maintained its trading stability amid a falling dollar index after the Federal Reserve meeting, pointing towards a potential minor price recovery. The upcoming U.S. nonfarm payrolls report is crucial for determining market sentiment and the direction of BTC price movements.

Expected to show a slowdown in job creation for March, the nonfarm payrolls report is highly anticipated by investors and analysts alike. Projections suggest an addition of 243,000 jobs, with the unemployment rate remaining below 4% for the 27th consecutive month. Average hourly earnings are also forecasted to rise by 0.3% month-on-month, consistent with the previous month’s gains.

As bitcoin demonstrates signs of stability and the dollar weakens, market focus shifts towards the possibility of an interest-rate cut or liquidity easing in November. This dynamic is further supported by the dollar index’s decline to 105.20 post-Fed meeting.

Market experts, such as those at ING, are closely monitoring the jobs report’s impact on the dollar’s performance and subsequent market reactions. With a projected net speculative positioning on the dollar against G10 currencies at its highest since June 2019, there is potential for a significant long squeeze in the dollar if U.S. data softens in the coming weeks.

The correlation between the dollar and bitcoin remains crucial, as a weaker dollar often translates to positive outcomes for risk assets like cryptocurrency. As investors await the outcome of the nonfarm payrolls report, the potential for further market movements and implications on crypto assets like bitcoin remains a focal point for industry players.