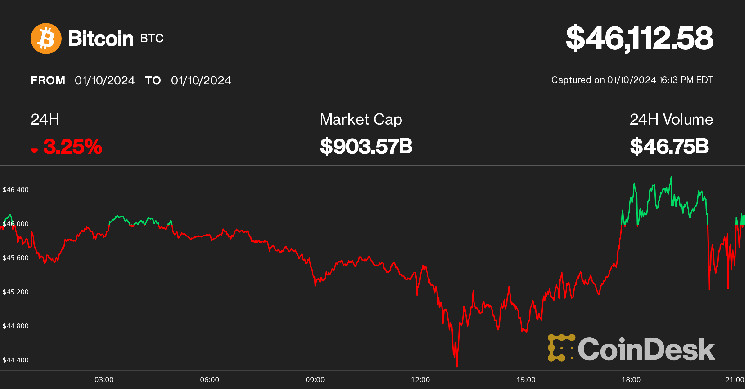

Bitcoin (BTC) experienced a volatile day, initially climbing to $46,200 before dropping to $45,000, following the approval of spot-based BTC exchange-traded funds (ETF) by the U.S. Securities and Exchange Commission (SEC). This decision was a significant milestone for the digital asset industry but was accompanied by market turbulence.

The Cboe exchange’s retraction of a filing related to spot BTC ETFs caused a sudden drop in Bitcoin’s price, spooking investors who had experienced wild price swings the day before due to a false approval announcement on the SEC’s official X (formerly Twitter) account.

Meanwhile, Ether (ETH), the second-largest cryptocurrency by market cap, saw a 12% jump to over $2,500 for the first time in 20 months. Attention is now shifting to spot-based ether ETF applications that have been filed with the SEC.

The Grayscale Bitcoin Trust (GBTC), the largest closed-end bitcoin fund, recently received permission to convert into an ETF, leading to a surge in its share price to $40, the highest since December 2021, according to TradingView data. Similarly, companies like Coinbase (COIN), Marathon Digital (MARA), and Riot Platforms (RIOT) remained relatively stable in the wake of these developments.

The imminent arrival of the first bitcoin ETFs in the U.S. that can hold the underlying asset has injected optimism into the crypto market. It is anticipated that these ETFs will attract significant inflows to the largest cryptocurrency, with many considering them superior to the currently listed futures-based offerings.

Despite numerous failed attempts over the past decade to list spot bitcoin ETFs in the U.S., the consensus among market observers was that regulatory approval was inevitable this time. This expectation was driven by BlackRock’s successful track record in similar applications and Grayscale’s legal victory against the SEC in August.

With the approval secured, industry attention is now focused on the potential demand these investment vehicles will attract once they commence trading. This will be a significant driver of market sentiment and price action in the coming weeks and months.